- You are in

- Home ›

- HOW TO VALUE A PROPERTY ?

HOW TO VALUE A PROPERTY ?

29/06/2022

When one needs to buy a new home or sell one's own, it is very important to have an idea of how to value a property. Although people often fall into the mistake of valuing their property by comparing it with other similar properties, in reality the precise and analytical valuation depends on many conditions; the objective analysis is bound to specific factors or parameters that change the final valuation.

In the next few lines we will consider the various aspects that determine the value of a property whether it is new or dated.

The importance of valuing property before selling it

In order to be able to sell your property in the best possible way it is essential to understand its value. Although requesting an objective valuation by a specialist may be the best solution, in this article we will try to outline the guidelines to follow in order to obtain a basis on which to evaluate the potential sale of your property.

Understanding what the value of one's own property might be is useful not only to get the most out of it in the event of a sale, but can also be indispensable to get a clearer idea of the costs of a possible house to buy.

Most people are used to thinking that the value of a civil home is the value at the time of the deed and purchase, but in reality the value of a property is influenced by many other essential factors, which can ensure that its cost increases or decreases over the years.

Do you want an indication of your property value? Click here https://www.mdagroup-re.ch/en/evaluation/ to check the value in only 6 clicks!

A mathematical formula for valuing property

Going into more detail about the formulas to be used for the valuation of property, it is possible to identify one, referring to the Italian regulations, which gives a clearer picture of how much the building envelope is worth in just a few seconds.

It must be emphasised that it is essential to consider this type of calculation as an example. Especially if you want to value your property in order to put it up for sale in Ticino, it is strongly recommended that you contact a professional or agency for an accurate valuation.

But let's see how, with a simple formula, you can determine the market value of a property with a good approximation.

V.M.=S.C. X Q. X c.m.

V.M.: Market value

S.C.: Commercial surface area

Q: Quotient per square metre

c.m.: coefficients of merit

It can therefore be inferred that the market value of a property is given by the multiplication of the commercial surface area by the quotation per square metre and the coefficients of merit.

Specifically, it should be emphasised that the commercial surface area is nothing more than the sum of the covered and uncovered surfaces; for example, the surfaces of the house, garden and terraces. The square metre quotation can be effectively identified by the average of quotations in the area where the property is located, while the coefficients of merit are nothing more than specific characteristics of a property that have a direct relation to its value.

The commercial surface

In the preceding lines it has become clear how important it is to know the commercial surface area in order to value the property. Although we have mentioned what its constituent elements may be, it is important to give it a more precise definition. The term commercial floor area identifies that portion of a property that can be walked on, which in many cases is mistakenly considered to be devoid of certain elements.

The commercial floor area is also made up of perimeter walls and balconies, components that are in many cases forgotten by those assessing total floor areas. When calculating the commercial floor area, one has to take into account the walkable square metres and then add the perimeter walls.

To simplify the calculation, in most cases 15 per cent of the floor area is added.

Once the floor area has been calculated and the perimeter walls have been added, the measurements of balconies, terraces and gardens should be included, but only in a proportion of 10 to 50 per cent of their surface area. The sum of these elements gives an objective value of the floor area.

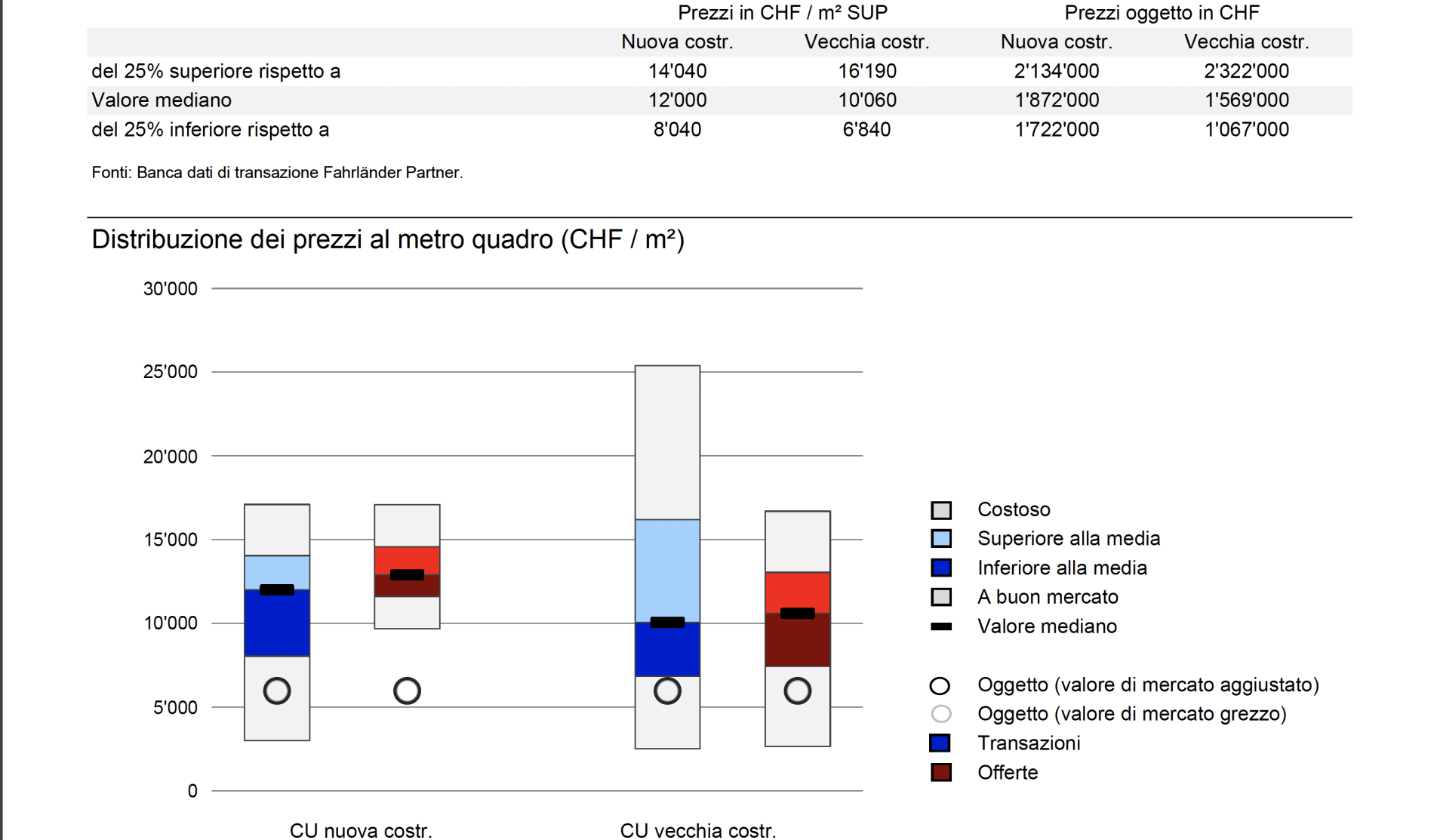

Square metre valuation

In addition to the analytical valuation of the commercial surface area, it is also important to calculate the square metre valuation of the property.

Unfortunately, a property in the square metre measurement can vary in its valuation depending on many factors, such as the neighbourhood in which it is located or the tourist and historical interest of its geographical location.

The coefficients of merit for calculating market value

In the main formula for calculating the value of a property there are coefficients of merit, but what are they and how can they be derived? This term refers to the amount added to or subtracted from the actual value of the house. If a household has merits or demerits, these would be considered within the merit coefficients.

Given the infinite differentiation of merit coefficients, two main categories were introduced to facilitate the calculation: all coefficients due to external factors and all those due to internal factors. External factors include all those elements related to the geographic location of the property; while internal factors refer to the real characteristics of the property, such as the city of reference, the services available in neighbouring areas and the safety of the neighbourhood in which one is resident.

The impact of the reference plan

It is interesting to analyse a property's valuation considering the reference plan. Buildings with a large number of dwellings have a different valuation depending on where they are located. Generally speaking, a property located on the ground floor has a lower value than a dwelling on the top floor.

There are well-defined percentages for calculating the value of the property depending on the floor. Specifically, it can be determined that a property on the ground floor without a garden has a value of -20%, on the ground floor with a garden -10%, on the first floor -10%, on the second floor with a lift -3%, on the second floor without a lift -15%, floors above the second floor with a lift +5%, upper floors without a lift -30%, top floors with a lift +10%, top floors without a lift -30%, penthouse with a lift +20% and finally a penthouse without a lift has a reduced value of -20%.

These are rough values that should be further investigated with an estimate by our professionals

Brightness and exposure: coefficients of merit

In the previous lines we have analytically examined how to value a property, but it is possible to find different variations due to coefficients of merit. Among the most important parameters to pay attention to are brightness and exposure. As is easy to deduce, a property with a good exposure is certainly brighter, but at the same time subject to an increase in heat on the perimeter walls.

A property with a very good exposure increases its value by +10%, while if it is particularly poorly exposed it affects it by -5%. Similar reasoning can be transposed to the exposure and the view, which can affect from -5% to +10% depending on the characteristics.

We would like to emphasise how the assessment of the coefficients of merit can make a considerable difference when approaching a property used as a civil residence or as an office. In the latter case, it is essential that the building envelope is located on a main street in order to obtain an excellent rating, as well as the layout of warehouses and floors for employee and customer access.

Read the other news:

- LIVING THE COLLINA D’ORO BETWEEN COMFORT, NATURE, AND INTERNATIONAL PRESTIGE

- PENTHOUSE IN BISSONE: A PEACEFUL OASIS OVERLOOKING LAKE LUGANO

- MORTGAGE RATES ARE FALLING: A GREAT OPPORTUNITY TO BUY PROPERTY IN SWITZERLAND

- COMMERCIAL REAL ESTATE IN LUGANO: A STRATEGIC INVESTMENT OPPORTUNITY

- WHY THE REAL ESTATE MARKET IN TICINO REMAINS RESILIENT IN EVERY MARKET CONDITION

- WINDOWS AND ENERGY EFFICIENCY: WHEN IT MAKES SENSE TO REPLACE YOUR FRAMES

- COMMERCIAL RELOCATION: MOVING YOUR BUSINESS TO TICINO, WHY IT MAKES SENSE AND HOW TO DO IT

- REAL ESTATE VALUATION IN TICINO: WHAT DETERMINES PROPERTY PRICES?

- YOUR HOME IN TICINO: A GATEWAY TO ITALY AND EUROPE

- IDEAS FOR TRANSFORMING YOUR INTERIOR: DESIGN TIPS TO ENHANCE YOUR HOME

- RESIDENTIAL RELOCATION: LIVING AND WORKING IN LUGANO, THE PERFECT CHOICE FOR A FRESH START

- HOUSEPLANTS: HOW TO CHOOSE THE RIGHT ONES TO CREATE THE PERFECT ATMOSPHERE