THE SNB'S KEY INTEREST RATE CUT AND THE SWISS REAL ESTATE MARKET

20/12/2024

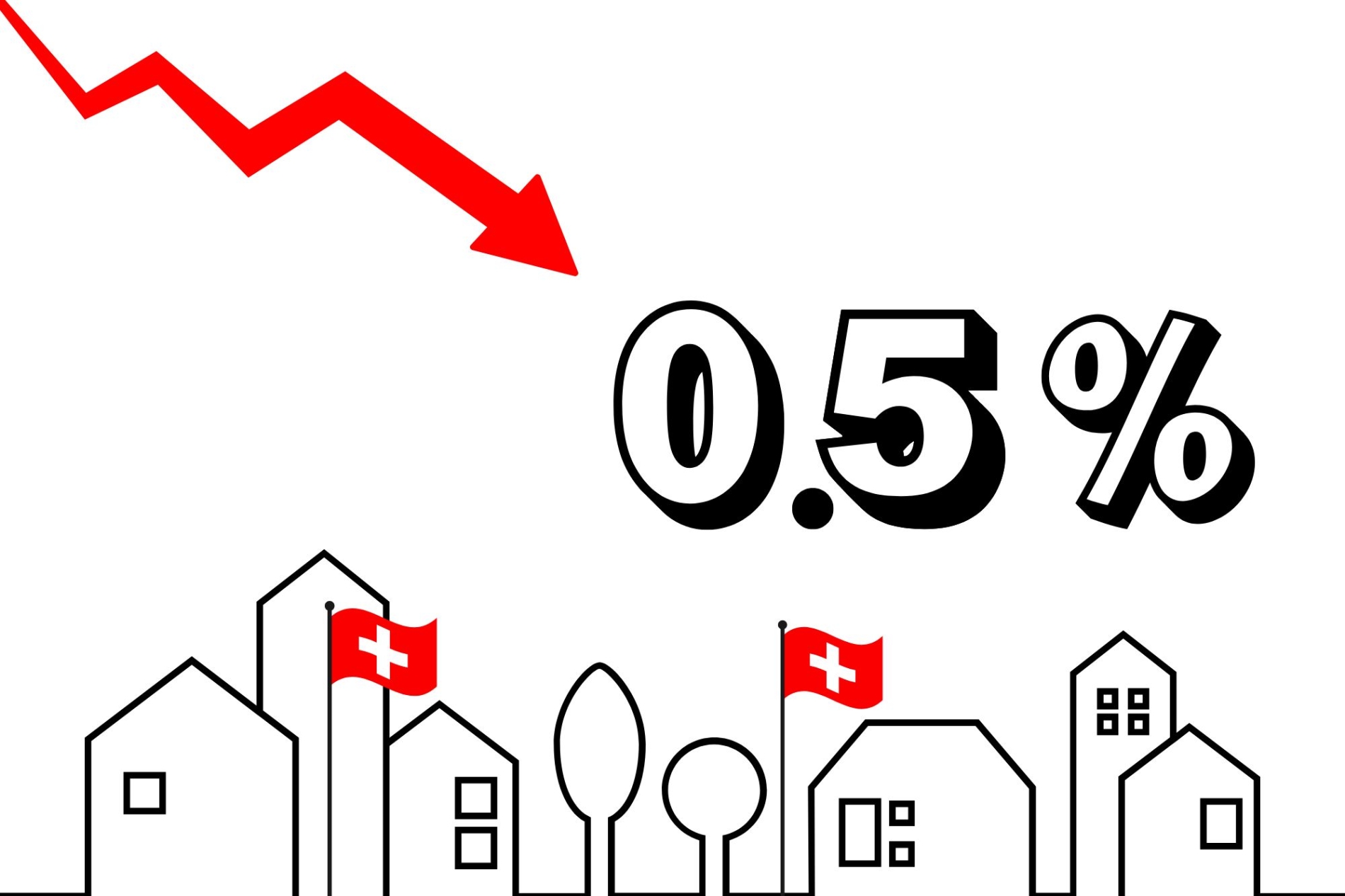

The recent decision by the Swiss National Bank (SNB) to reduce its reference interest rate from 1.0% to 0.5% marks a significant move that will have repercussions across various economic sectors, including the real estate market.

This cut, the most substantial in the past decade, was motivated by the need to counter inflationary pressures and prevent further appreciation of the Swiss franc. For those considering buying or selling a home, this decision opens up new and exciting opportunities for both buyers and sellers alike.

Let’s take a closer look.

The Impact on Mortgage Rates: A Boost for Buyers

One of the most immediate effects of the lower interest rate is the possibility of obtaining mortgage loans under more favorable conditions. With lower interest rates, banks are incentivized to reduce the cost of credit for end customers, making it more affordable to finance a home purchase.

For buyers, this translates into lower monthly payments and greater access to the real estate market, especially for first-time homebuyers.

Until recently, high mortgage costs had deterred many potential buyers, but this shift could represent the ideal time to take the plunge.

Lower rates also enhance spending power. Buyers may now afford higher-value properties or those with superior features, driving demand toward better-positioned homes equipped with modern and sustainable technologies. This effect could be particularly pronounced in urban centers, where property prices tend to be higher.

A New Outlook for Sellers

From a seller’s perspective, the interest rate cut is equally advantageous.

With increased demand fueled by more accessible mortgages, it is highly likely that the real estate market will enter a more dynamic phase. More buyers in the swiss real estate market mean more sales opportunities, potentially with shorter turnaround times and more competitive prices.

This situation could be particularly beneficial for those looking to sell a property to reinvest in another project, such as a new home or an income-generating property.

The greater liquidity in the financial system and heightened buyer interest could also facilitate negotiations, reducing the discount margin on listing prices.

An Opportunity for Real Estate Investors

Finally, the rate cut has a significant impact on investors.

With lower bond yields, real estate investments are once again one of the most attractive options for those seeking stable, long-term returns.

This phenomenon is likely to drive increased demand for properties among private and institutional investors, particularly in the rental housing and commercial property segments.

Investors could take advantage of the situation to acquire income-generating properties, benefiting from both low financing costs and growing rental demand, fueled by limited property access for some segments of the population.

Conclusion

The SNB’s key interest rate cut represents a pivotal shift for the Swiss real estate market, offering opportunities for both buyers and sellers.

On the one hand, more affordable mortgages make homeownership more accessible. On the other, increased demand can facilitate sales and stimulate the entire sector.

For anyone considering a real estate transaction, now is the time to act.

Consulting industry professionals is essential to successfully navigate a changing market and make the most of the opportunities presented by this new economic phase.

Are you considering buying or selling a home in Switzerland?

Contact us for a chat; we would be delighted to put our expertise and market knowledge at your service!

Read the other news:

- LIVING IN NATURE: CONTEMPORARY APARTMENT FOR SALE IN CAPRIASCA

- LIVING THE COLLINA D’ORO BETWEEN COMFORT, NATURE, AND INTERNATIONAL PRESTIGE

- PENTHOUSE IN BISSONE: A PEACEFUL OASIS OVERLOOKING LAKE LUGANO

- MORTGAGE RATES ARE FALLING: A GREAT OPPORTUNITY TO BUY PROPERTY IN SWITZERLAND

- COMMERCIAL REAL ESTATE IN LUGANO: A STRATEGIC INVESTMENT OPPORTUNITY

- WHY THE REAL ESTATE MARKET IN TICINO REMAINS RESILIENT IN EVERY MARKET CONDITION

- WINDOWS AND ENERGY EFFICIENCY: WHEN IT MAKES SENSE TO REPLACE YOUR FRAMES

- COMMERCIAL RELOCATION: MOVING YOUR BUSINESS TO TICINO, WHY IT MAKES SENSE AND HOW TO DO IT

- REAL ESTATE VALUATION IN TICINO: WHAT DETERMINES PROPERTY PRICES?

- YOUR HOME IN TICINO: A GATEWAY TO ITALY AND EUROPE

- IDEAS FOR TRANSFORMING YOUR INTERIOR: DESIGN TIPS TO ENHANCE YOUR HOME

- RESIDENTIAL RELOCATION: LIVING AND WORKING IN LUGANO, THE PERFECT CHOICE FOR A FRESH START